Estate Planning template for South Africans

| Main centres: | 1-3 business days |

| Regional areas: | 3-4 business days |

| Remote areas: | 3-5 business days |

| Main centres: | 1-3 business days |

| Regional areas: | 3-4 business days |

| Remote areas: | 3-5 business days |

Built by a Fiduciary Practitioner FPSA®

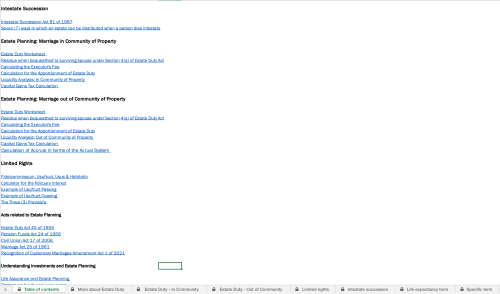

This is an Excel workbook that can be used by students and professionals to plan their estates at death and learn more about estate duty and other costs associated with winding up a deceased estate.

The workbook contains templates, hyperlinks, and calculators for:

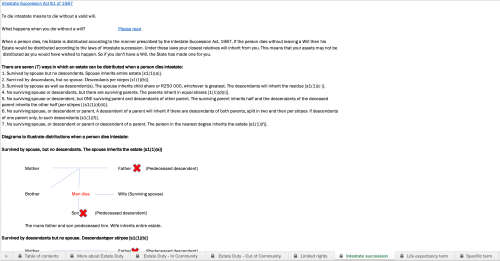

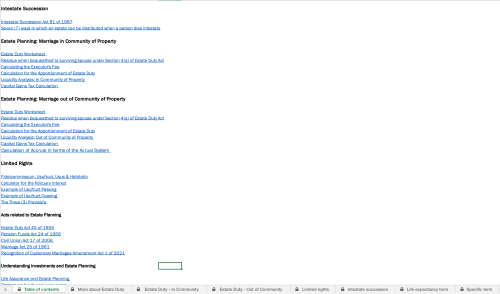

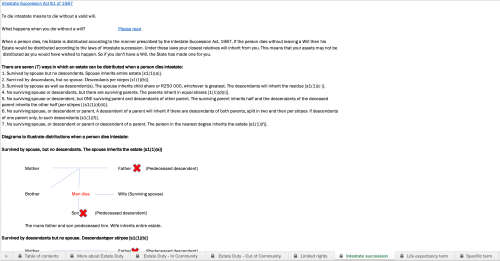

1. Intestate Succession

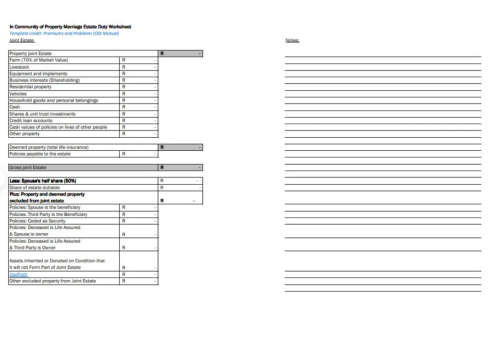

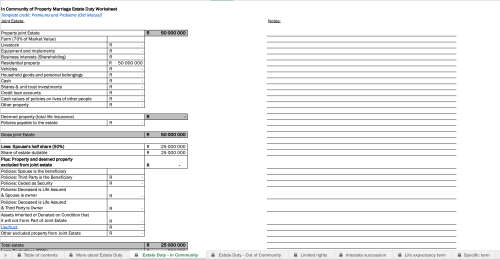

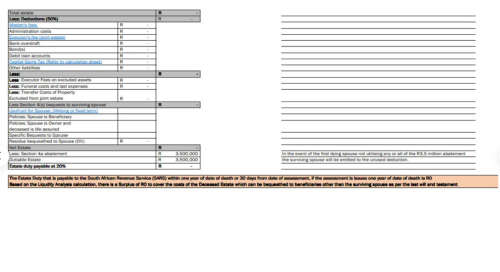

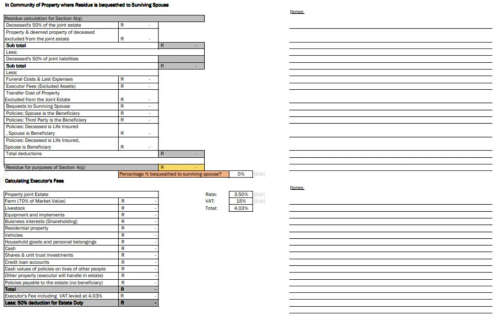

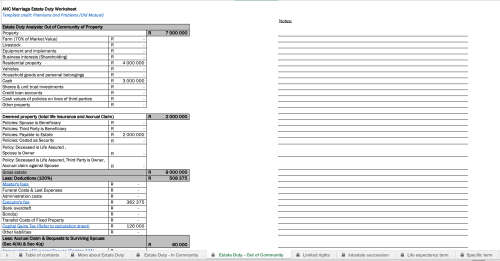

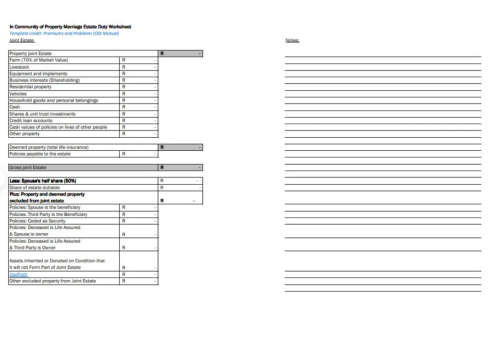

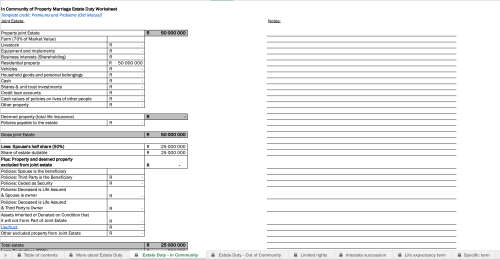

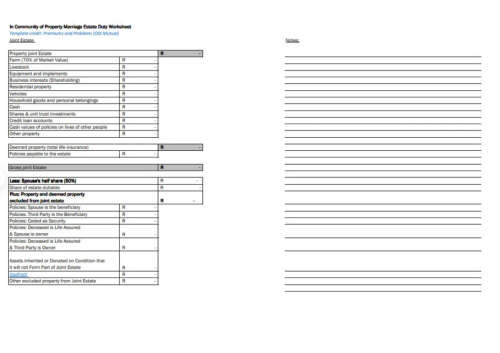

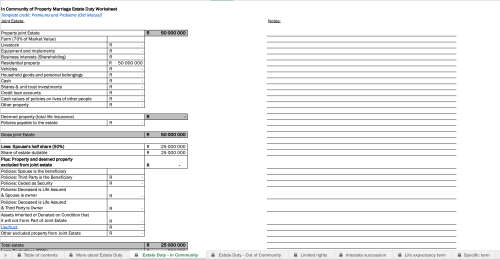

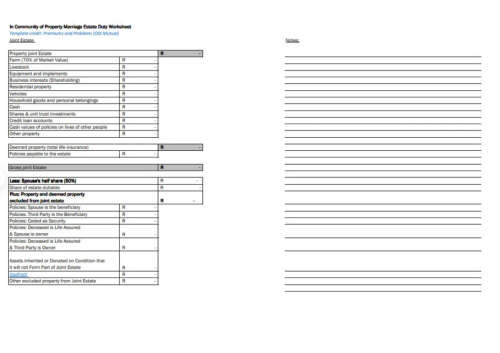

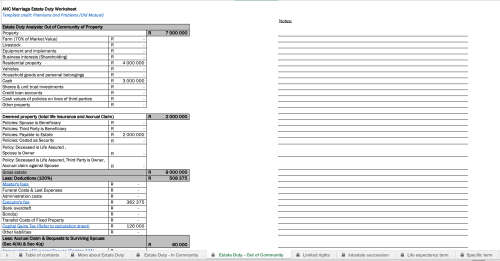

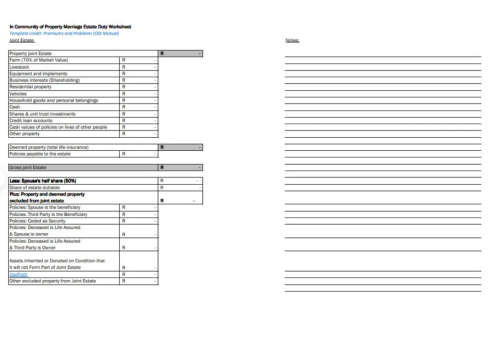

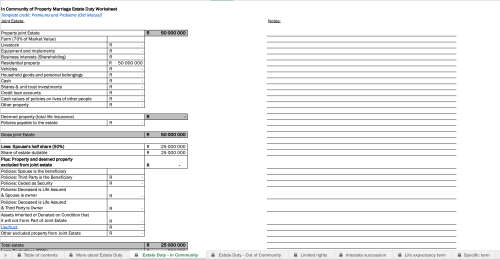

2. Estate Planning - In Community of Property

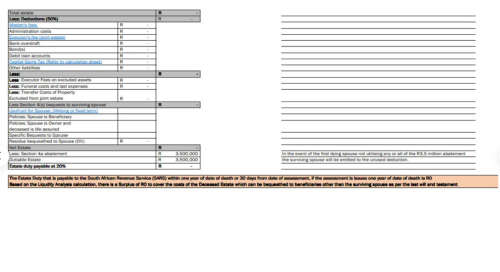

- Estate Duty

- Liquidity analysis

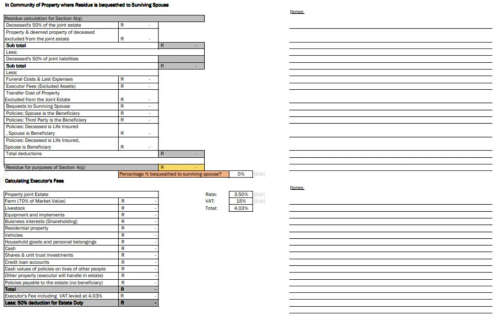

- Residue for surviving spouse

- Executor's Fees

- Apportionment of Estate Duty

- Capital Gains Tax

3. Estate Planning - Out of Community of Property

- Estate Duty

- Liquidity analysis

- Residue for surviving spouse

- Accrual claim

- Executor's Fees

- Apportionment of Estate Duty

- Capital Gains Tax

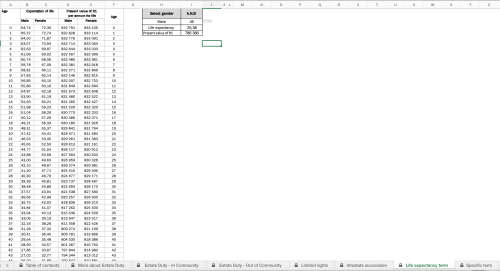

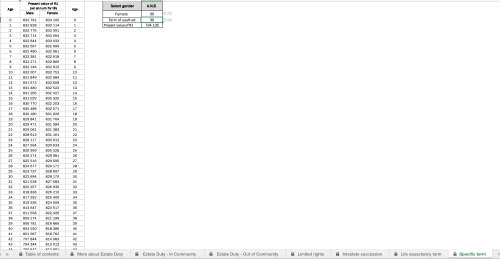

4. Limited Rights

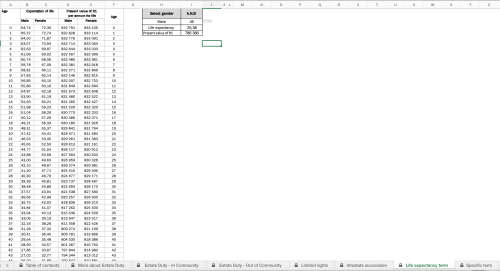

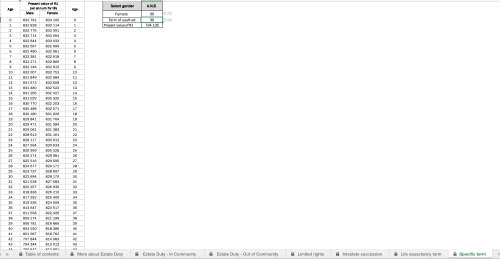

- Calculator for fiduciary interest (usufruct) with mortality tables pulling through data automatically

5. Acts related to Estate Planning