Rental property analysis for South Africans

| Main centres: | 1-3 business days |

| Regional areas: | 3-4 business days |

| Remote areas: | 3-5 business days |

| Main centres: | 1-3 business days |

| Regional areas: | 3-4 business days |

| Remote areas: | 3-5 business days |

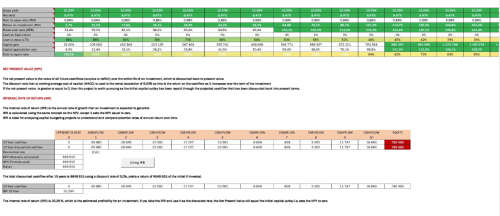

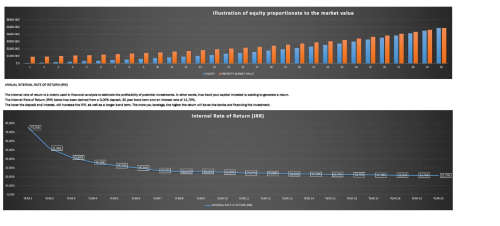

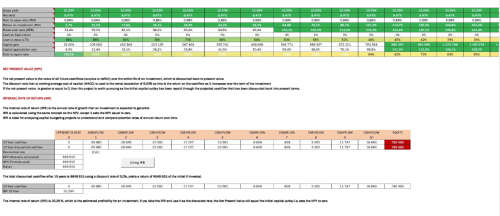

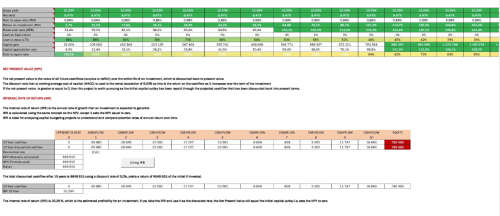

This advanced template can be used to model the cash flow of a new or second-hand property you wish to acquire by using assumptions to forecast income and expenses and compare the "opportunity" cost to that of a traditional investment over a 10 and 20-year period.

You can project cash flows using assumptions and then measure the forecasted performance using ratio analysis which includes:

- Gross Yield

- Net Yield

- Rent to Value

- Return on investment

- Break-even ratio

- Cash on cash return

- Loan to value

- Capital gain

- Capital appreciating rate

- Debt to equity ratio

- Solvency ratio

- Years until breakeven

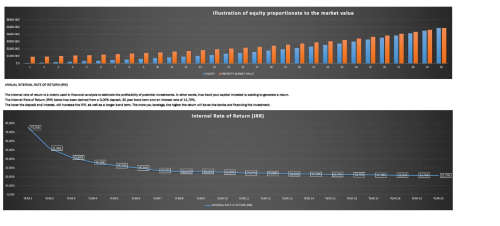

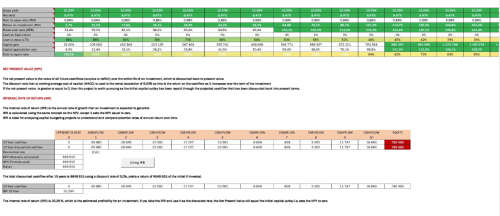

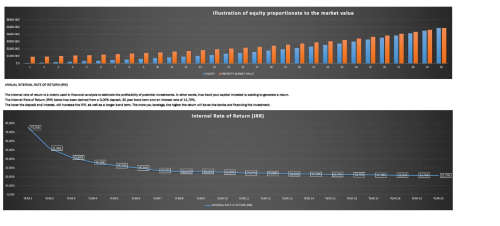

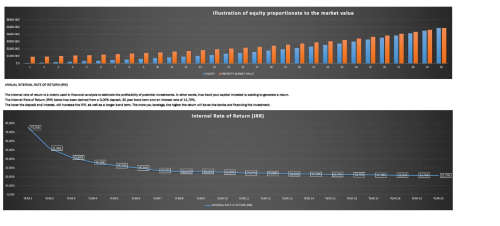

In addition, there is a measure of the Net Present Value (NPV) and Internal Rate of Return (IRR). These calculations determine whether or not it is worth pursuing an investment opportunity by using discounted cash flows. There is also an IRR comparison between investment property and a traditional investment vehicle where a lump sum is invested and annual compound interest is achieved.